It was great to have our 21 year-old daughter, Ariana, for dinner last night. She was studying for her spring finals as her junior year of college winds down at the University of Iowa. She says, “I just saw this, and you two might find it interesting.” Normally it would reference a Tik Tok video, some news about the Hawkeye football team or even a dinner recipe she’d like me to try for something different. Maybe, just maybe, she knew something about my beloved Minnesota Vikings that I hadn’t heard yet. Not hardly. Rather, she advised us of an article about how the IRS changed the rules of the PPP (Paycheck Protection Program). This news was doubly hard to swallow: first for being unwelcome news from the IRS, and second as an indication that my lovely little girl has reached adulthood (much to my chagrin.) [The link for the article is http://nahbnow.com/2020/05/irs-expenses-paid-with-forgiven-ppp-loans-are-not-tax-deductible/ ]

The news of this article empowered me to do some research. That research then indicated that I needed to contact my friends in banking and accounting industries to clarify. These professionals confirmed, to the best of their knowledge, that the IRS did publish new rules which changed the intention of the program as it had been presented to the waiting public. This is where I interject a short disclaimer recognizing that I am not a financial advisor or attorney and that you should seek professional counsel as it relates to your situation. (Most of your are very clear on that already! Ha ha!) I simply shared this with you in that many companies applied for assistance from the PPP to empower their company through this difficult time. If not your company, certainly you do business with others that did apply for this assistance. Therefore, directly or indirectly, we will all be impacted – both positively and negatively – by the PPP program. Attached to this email is a PDF document entitled, “Notice 2020-32.” I would bet that, in the end, you will find yourself as confused about this topic as you felt before you started. Luckily, I was able to reference other articles at the end of this letter that do bring some clarity to the situation; albeit clarity that indicates the IRS had other plans from what we were told.

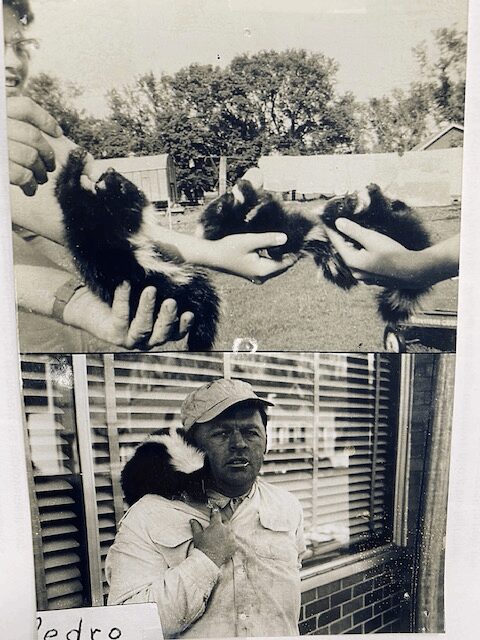

I was weighed down by this news as I sat in my office to write today’s letter. I lifted my head to gain perspective and glimpsed the youthful pictures of my grandpa (attached.) Bud Devereaux worked as a farmer or with farmers his whole life. Everything about Bud was unique. He cooked wild game which included such things as rabbit, raccoon, turtle and most of all his all time favorite rocky mountain oysters. He made from scratch knives and wine in the basement. He and Grandma only had 11 children to raise. He had a pet skunk named, “Pedro.” Here is the backstory to the pictures attached. Grandpa Bud found 5 orphaned skunk kits due to the mother having been killed. Bud removed the scent glands from one of the kits and raised it as a pet. This culminated with Bud walking down Main Street, a toothpick playfully dangling from his lips and a skunk around his shoulders greeting proper ladies as they walked out a beauty parlors, the Five and Dime store and the grocery store. Even small-town Iowa has always had their characters.

Every moment I spent with Grandpa Bud was also unique. Like the time I went fishing with him. You might not think fishing with grandpa was unique. Bear this in mind: I drove my car with Grandpa and towed his boat behind. When we arrived, I was going to let grandpa back it down the boat ramp. “What the hell are you up to?” and he instructed me to get back behind the wheel. Grandpa Bud spent 1/2 hour trying to teach 16 year-old me how to back the trailer down the boat ramp. 30 minutes of back-and-forth, wheel-turning, patience-grinding torture for both of us. (But I still know how to back a trailer from that experience!) With the boat finally in the water, it was time to fish. After a while it was time for a bite of lunch – cinnamon roll bologna sandwiches. Imagine it if you will: six cheap, factory-made cinnamon rolls glistening with icing sitting in a flimsy paper box inside a clear plastic bag. Remove a roll (getting icing all over your hands) and sandwich it between two slices of bologna and voilà! After dispensing of this fine dining experience, you prepare your dessert with a palm of salted peanuts being dumped into a bottle of Pepsi which produces this unequalled palate experience. It amazes me how after more than 30 years these memories and tasted are etched into my memory to the point I can taste every bit of that meal.

That’s not all Grandpa Bud left me with. He was also sure to teach me that if something seems to good to be true, look around the corner for the dark side of whatever the gift was. If the government is involved – there is always a gothcha! With the PPP situation, the gotcha came after-the-fact, but it does seem to be here. Without saying it, though, he also left me with these reflections I could have never learned in that day. In regards to backing up the trailer – don’t give up. Have patience. Like the struggle of the back-and-forth with things turning the ‘wrong way’ in my head, today’s business world is just like that. So we must stay engaged with our company and our business even though it feels unnatural. If we stay diligent and alert we will finally put the boat safely in the water. Add to that the idea that if you see a skunk on someone’s shoulder, it doesn’t have to stink. Just because the IRS is changing the game doesn’t mean the PPP is only bad news, we just have to know how to deal with the scent glands and everything will be OK.

This wraps up weak 8. Or, rather, week 8. Blessings for you to be healthy, stay engaged, stay fun and don’t be afraid to stir things up with a skunk on your shoulder.

Bill